Whether you have an established warranty program or are evaluating one of the many product warranty options out there, you’re already doing something right. Today’s shoppers want transparency and, above all, better customer experience (CX). Offering a warranty program checks many of the right boxes as you begin ascending the CX landscape.

Product Protection, the secret enterprise weapon

By offering product warranties retailers gain CX footholds against giants like Amazon (note their protection offering below).

When competing against enterprise retailers, how you play the game is just as important as being in it at all. Examining the value of warranty programs, the key measures of success are CX and operational efficiency. Operational efficiency that works in earnest doesn’t cut corners. Instead it comes as teams find and adopt better ways to build on the basics. With efficiency and CX in mind, Apple, Walmart and Amazon partner with product insurers to offer product protection in addition to manufacturers’ warranties. These four reasons are why:

Risk removal All retailers want to guarantee value. But those promises come with a price. Insurance companies take on the financial risk of repairing or replacing items as a part of their business model.

Dedicated customer support Insurance administration organizations (admin) provide businesses with an outside team dedicated to meeting customer needs and ensuring that claims are cared for.

Breadth of coverage Insurers add value by providing a dedicated pool of money to cover mishaps, even those outside of the typical defect, including challenges like wear and tear, water damage, theft and many more.

Focus With insurance companies and admins crossing the T's, manufacturers and retailers are free to focus on developing the core functions of their businesses.

Boxes that your product warranty should check:

Transparency

Federal and state compliance

Ease of understanding

Customer’s ease of access to insurance

Acknowledgment of risk

Support for both your business and your customers

Here is our breakdown of the product warranty landscape:

The Offerings in Detail

Manufacturer’s warranty (limited or full)

The manufacturer’s warranty is the first step to providing customers the assurance and transparency that they need. These warranties often cover product defects and merchantability - ensuring that new products sold look and function as new products should. They may also outline a limited set of circumstances under which the product can be either repaired or replaced.

Self-insured extended warranty

Self-insured extended warranties may be purchased by customers who want to protect the value of their purchase for longer than a manufacturer’s warranty may provide. By sticking to the provisions of that original warranty, the greatest addition a store-managed extended warranty offers is time. In this instance, the store takes on the potential risk of paying for repairs and replacements.

Clyde Product Protection

The greatest shift from self-insured extended warranties to product protection is a change in liability. Committing to repair or replace products is a financial risk. Product protection is backed by an outside insurer who takes on that risk. This liability is taken in exchange for an insurance premium that customers pay as a one-time fee. Homeowner’s insurance and car insurance are both great examples of this practice in related industries. The only difference is that homes and cars are much larger expenses than the average over-the-counter product, so those premiums are much larger and can be paid monthly.

As a function of accessing product insurers, third-party product insurance comes with a dedicated outside admin team that provides customer service. The admin team is available for 24/7 support and ensures your customer is cared for.

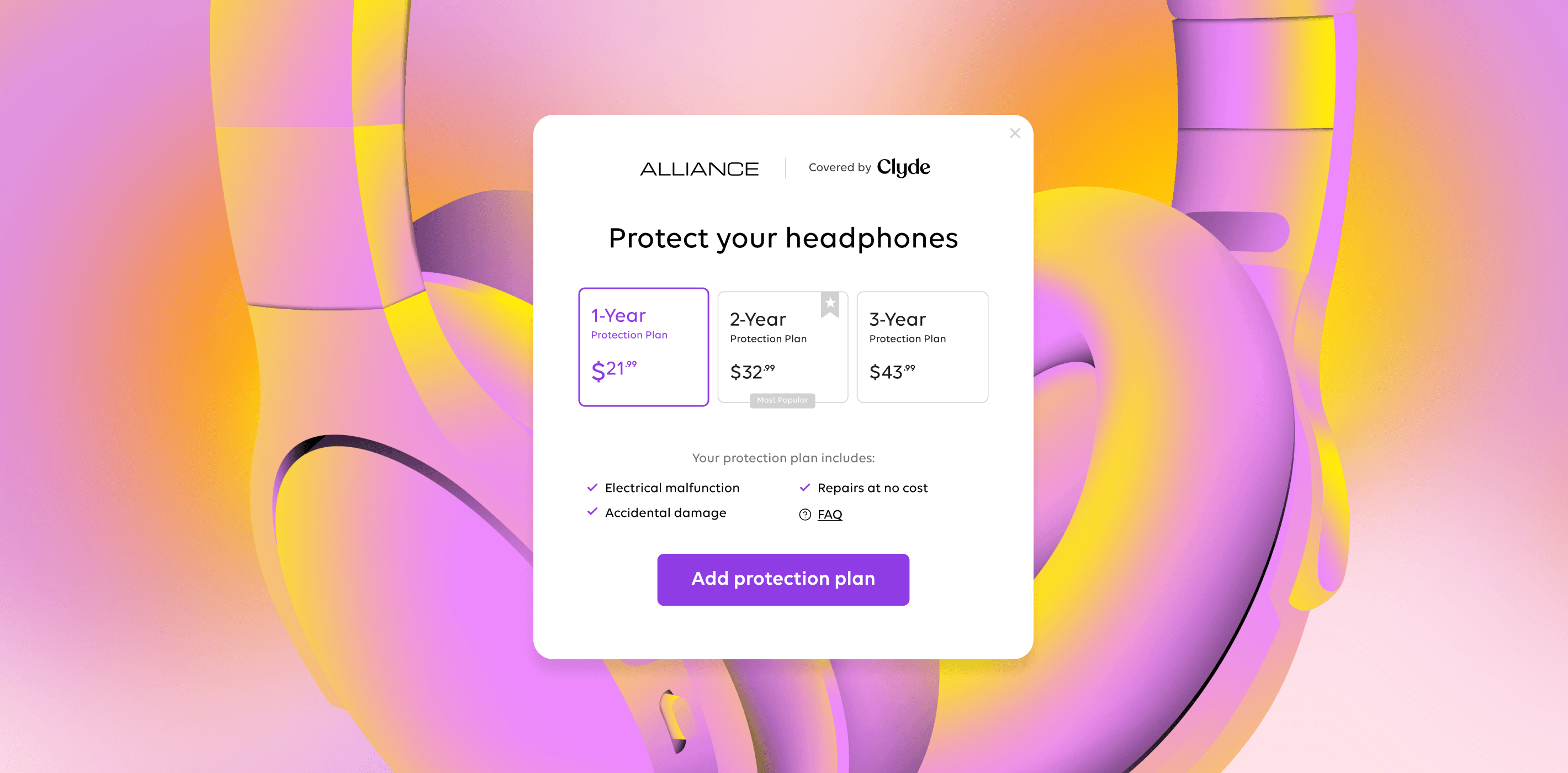

Clyde ADH Product Protection

Clyde’s Accidental Damage from Handling (ADH) Product Protection plans start at the time that the plans are purchased, and they cover accidental damage alongside the manufacturer’s warranty. ADH protection is more robust coverage than your standard manufacturer’s warranty. Depending on the insurer and the needs of the product sold, ADH protection can be expanded to include a wide range of coverage options. In line with the product protection above, ADH coverage includes a dedicated admin team to care for customer needs. ADH product protection gives peace of mind, assuring customers that they are protected from life’s what ifs and mishaps.

Why Clyde?

Clyde product protection plans are insured and administered by the same institutional insurers that have been behind the product insurance industry for decades. We started Clyde with the idea that all merchants ought to have access to product protection that fits their business, regardless of size and technology requirements. As a result we built a plug and play platform, and we negotiate with our network of top insurers to provide the best fit product warranty solutions to each of our partner businesses.

SIGN UP FOR OUR NEWSLETTER