If you manage an ecommerce business, you know there’s no shortage of things that you could decide to become an expert in. Google Ads, for one. AI-enabled pricing strategies, for another. Headless ecommerce , performance-based marketing, microinfluencer partnerships, supply chain management…the list goes on and on.

But some things aren’t just helpful to know about—they’re required.

Understanding ecommerce payment processing is one of them.

Because at its core, a successful ecommerce store does three things:

Gets products in front of customers

Receives payment from said customers for said products

Delivers said products and provides a great experience for said customers

And that second thing—receiving payment—is quite pivotal.

From knowing what kind of payment options your audience is most interested in to understanding the tech that supports them (and how it plugs into your site), this guide will walk you through everything you need to know about ecommerce payment processing.

Ecommerce Payment Method Options Available For Customers

First, let’s look at the subject of ecommerce payments from a consumer lens. Because while you’re an ecomm business owner, you’re also an ecomm business customer whenever you buy something—be it sheets from Amazon or dinner from UberEats—online.

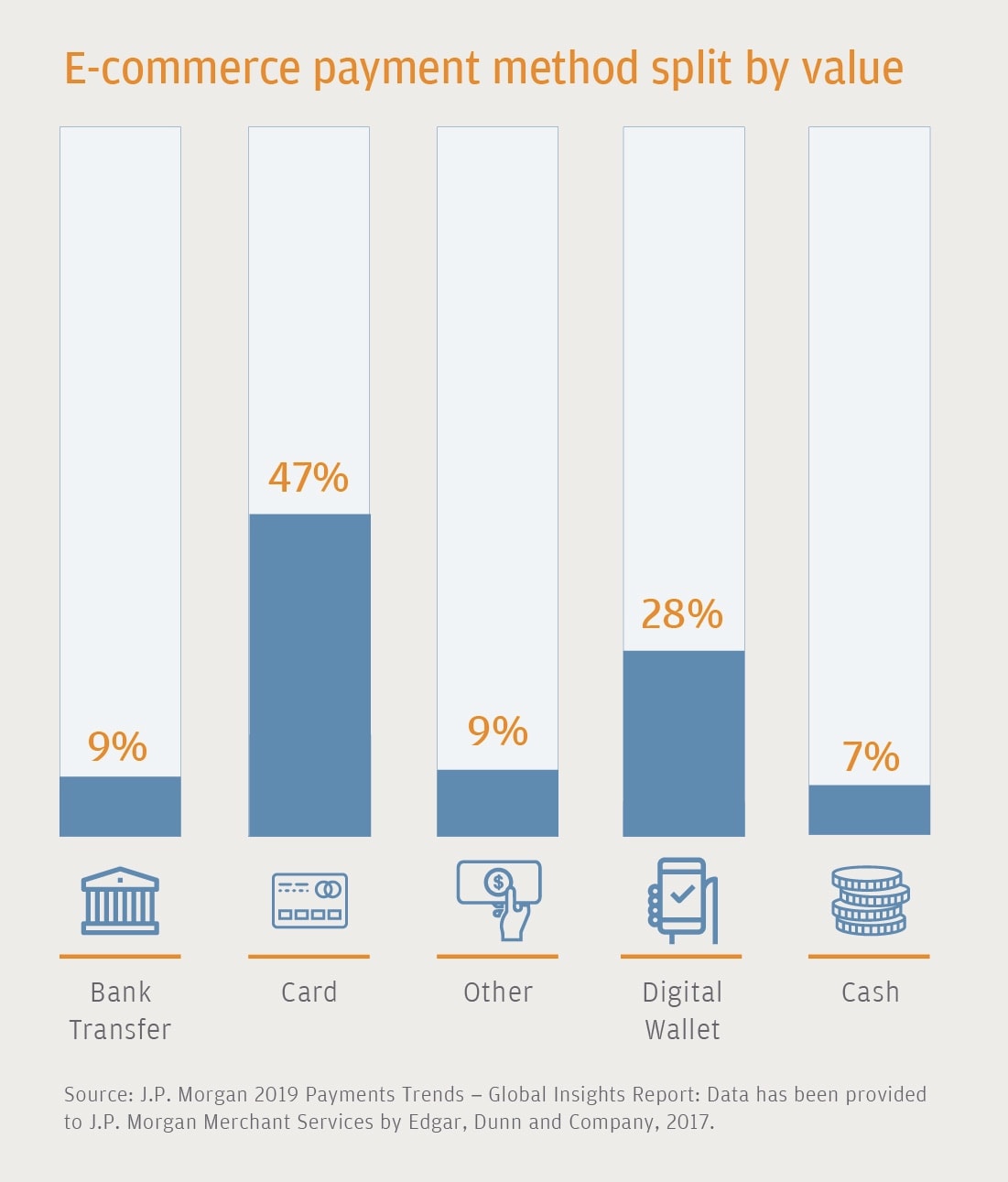

Do your preferences line up with the average American consumer? Per a JP Morgan study , the most popular forms of ecomm payments are:

Credit cards, used for 47% of all ecomm transactions

Digital wallets, or credit cards linked to cell phones, used for 28% of all ecomm transactions—and likely to be used for up to 20-30% more transactions in coming years, as U.S. merchants expand payment options to include it

Bank transfers, used for 9% of ecomm transactions

Other, including digital currency, used for 9% of ecomm transactions

Cash, used for 7% of ecomm transitions

Let’s go into what each of these payment options looks like.

Credit Cards

Let’s start our list off with the big person on campus: credit cards.

Credit cards are ubiquitous, at least in the United States. JP Morgan found that credit card penetration is higher in the U.S. than in almost any other market, with an average of 2.4 debit cards and 2.0 credit cards per person.

Take a look at your wallet (be it real or digital). It’s got a couple of pieces of microchipped plastic in there, doesn’t it?

Worldwide, credit cards account for 22.8% of all ecommerce transactions, per Statisca .

The credit card option is the top—and likely 3most popular—choice at this Spanish plant site’s checkout.

Direct Debit

Direct debit payments aren’t the same thing as a debit card. With a direct debit, payments are initiated by you (the merchant) and made directly from a customer’s bank account.

They’re supported by a network of financial institutions that varies depending on the location of the customer’s account. For instance, in the U.S., they go through the ACH network; in the UK, Bacs; and in Europe, SEPA.

They can take longer to settle than card payments, but are often cheaper for merchants and easier to manage for consumers (since there’s no risk of them spending money they don’t have).

The checkout options at online art investment marketplace Masterworks include a wire or ACH—aka direct debit—option. It takes longer to get to the company, but it costs less than paying with a credit card.

Digital Wallets (Google Pay, Apple Pay, Etc.)

Ever swiped your phone in front of a subway turnstile to pay? Tapped a credit card machine after a lunch out in lieu of handing the server cash or a physical card?

Digital wallets store virtual versions of payment options, like credit cards, debit cards, or bank accounts.

Wallets are becoming increasingly popular in physical spending (also called point of sale spending), with the Motley Fool reporting that they are the most common payment method for those sales.

But they’re growing in adoption online, too. A few clicks—particularly for ecomm purchases made from a cell phone—accompanied by some kind of customer verification (like a password or face scan) and a purchase is confirmed.

EVO Gimbals ’ checkout options include several digital wallets.

Buy Now, Pay Later

Buy now, pay later (BNPL) options offer exactly what their name implies: a way for customers to complete (and receive) their online orders now, while spreading out the payments for them over several installments.

It’s a popular option for consumers , as it gives them access to free credit. Sellers benefit, too, seeing 2-3x higher conversion rates, per McKinsey . It does come with a cost to sellers, though, who pay a few percentage points in fees.

Afterpay is a popular BNPL checkout option, along with Klarna , that works in a “pay in 4” model. Other options include Affirm and Splitit .

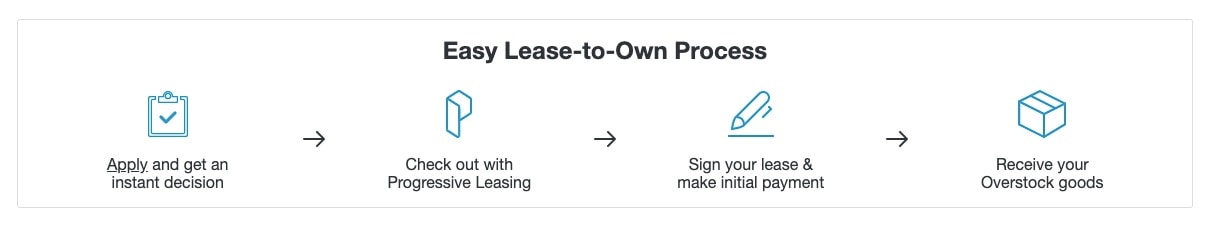

Lease-to-Own (LTO)

Providing a range of payment options serves one goal: getting your products in front of the widest possible customer base.

Lease-to-own payment options can be valuable to would-be buyers who may have bad credit or a wary approach to traditional forms of credit like credit cards.

Lease-to-own checkout solution Katapult claims that 47% of U.S. customers need financing help for purchases greater than $400.

Overstock.com offers a lease-to-own option that gives buyers of big-ticket furniture items 90-day and 12-month purchase options.

Digital Currency (Cryptocurrency)

Cryptocurrencies are decentralized, digital payment systems that are organized and monitored by peer-to-peer networks on the blockchain.

They’re like regular fiat currencies—except instead of dollars being monitored in a centralized location by the Federal Reserve, for instance, they have no intermediary.

As of the end of 2021, 16% of Americans have invested in, traded, or used cryptocurrency, per Pew . As that number grows, digital retailers who want to capture those consumers have started offering checkout options for popular cryptocurrencies like Bitcoin.

Luxury watch brand Norqain offers buyers the option to pay for their purchase with Bitcoin.

Ecommerce Payment Processing: Key Terms and Relationships

Once you recognize the variety of payment options that you can offer on your online store, it’s time to take a look at how they actually work.

Nearly all payment solutions use the same four key elements: payment gateways, payment processors, merchant accounts, and payment service providers.

Payment Gateway

A payment gateway is front-end technology that lets retailers accept online credit card payments.

Per Investopedia , it’s the customer-facing interface used to collect payment information.

In brick-and-mortar stores, that includes point of sale terminals. In online stores, that includes the checkout portals where you’d enter your credit card information or your login for bundled payment providers like PayPal .

We’ve gone from magnetic-strip credit cards with paper signatures to chipped credit cards with auto-fill online forms, and payment gateways will only continue to evolve.

For online retailers, popular forms of payment gateways include:

hosted form fields

Hosted widgets widgets

other APIs, including native hosted components

Square is a popular payment gateway for both in-person and online stores.

Payment Processor

To visualize the relationship between a payment gateway and a payment processor, think of a relay race.

After the payment gateway has collected the customer’s payment information, like name and credit card number, it encrypts it and sends it to a payment processor. That’s the baton changing hands.

The payment processor then uses that information to check that the customer has the funds (or credit) to make the purchase, then charges the customer’s bank or credit card company. (Or, in the case of some of the other payment methods explored above, then debits their cryptocurrency wallet, for instance.)

Once that happens, the payment processor sends the results back through the payment gateway, which is when customers get a notification that their transaction was approved and their purchase is on its way to them.

Merchant Accounts

A merchant account allows retailers to accept debit and credit card payments. It’s like a holding pen for those funds: customers’ money is deposited into a merchant account, and then merchants can send those funds to their business bank account.

Different types of merchant accounts come with different pricing structures, fees, and extra tools.

Some smaller retailers, including those who don’t yet have the credit history to get them approved for a merchant account, might rely on third-party processors like PayPal. More on those next.

Payment Service Providers (PSP) or Merchant Service Providers (MSP)

Payment service providers, also called merchant service providers, are third-party processors that combine payment gateways, payment processors, and merchant accounts.

PSPs are basically a buy-not-build approach to payment processing. Instead of setting up those elements individually, retailers can choose to use a PSP to do everything from gather their customers’ information to charge the customer’s bank to collect the money on the merchant’s behalf.

PSPs include:

7 Ecommerce Payment Processors Worth Considering for Your Store

While the most important thing that your payment processor needs to do is collect money on your behalf, there’s a lot of nuance in how exactly that gets done. Here, we’ll explore some popular payment processors.

1. PayPal

In the world of payment processors, PayPal reigns supreme. It’s accepted in 200+ countries and is the second most-trusted brand in the world (after only Google!).

Pros

Great for smaller retailers who can leverage the brand’s credibility and trustworthiness

Easy to set up, use, and integrate with other ecomm or retail payment solutions

Cons

Higher volume businesses who want to negotiate better pricing

Extra features, like fraud protection and recurring payments, come at a premium

2. Stripe

Stripe is a PSP used by merchants big and small around the world, and that was built by developers for developers. That makes it slightly more complicated to implement than other options, but also means that there is limitless personalization and integration potential for retailers with the technical skills to dig in.

Pros

Unified payment dashboard where retailers can see all incoming payments

Available worldwide in tons of currencies

No monthly fee or minimum

Cons

Fees to access subscription management services and custom reporting systems

Requires technical know-how to implement well

3. Square

While Square and its ubiquitous white card readers started as a point of sale (POS) solution, it’s since expanded into ecommerce offerings and infrastructure, and is a great option for many retailers.

The company behind the seller product Square is now called Block —but we’re calling it Square here since we’re referring to the ecommerce solution. (Block also owns Cash App, TIDAL, and other businesses.)

Pros

Great for retailers who do business both in-person and online

Very affordable and simple to use

No monthly fee or minimums

Cons

Merchants can have their accounts put on hold or terminated if they don’t have a long history

4. BlueSnap

BlueSnap was built to compete with the PayPals of the ecommerce world, and it’s done so by building an open API platform that’s just as helpful as big-name PSPs but is also a lot more customizable.

And you don’t have to be a developer to take advantage of the customization options, since most of them are built into easy-to-use dashboards.

Pros

Entirely customizable, down to fraud settings

Pre-built reports, such as daily transactions, active subscriptions, payment declines by reason, and more

Cons

Some features are offered through external vendors, which makes them harder to troubleshoot

Limited phone support

5. Klarna

Klarna , like its major competitor Afterpay, isn’t a traditional payment processor. It’s a buy now, pay later service provider that takes over the “payment gateway” part of the payment process.

It works by offering consumers a “pay in four” option. Customers can split their purchases into four installments, paid every two weeks for eight weeks, without incurring extra fees or interest fees. (Merchants do pay a fee, but they receive the full payment immediately upon the sale of the product.)

Pros

Broadens the range of customers that can afford to buy your products

Integrates directly with your site, so no need to send traffic off-site to fill out forms

Cons

Does not accept all merchants; works best with those whose average transaction amount is between $35 and $1000

Only available in select countries, including the U.S., UK, and several European countries

Still requires a separate ecomm system to process payments, like Stripe, Shopify, or others

6. PaymentCloud

PaymentCloud specializes in high-risk businesses that may have trouble accessing traditional merchant accounts. Those can include online-only retailers, as well as physical and ecomm retailers in specific industries, like supplements and e-cigarettes.

They aren’t a direct processor themselves, but rather partner with various banks and processors to give merchants access to various payment options.

Pros

Built-in fraud protection

Automatic data migration

No application fee or annual fee

Cons

No public pricing models

High-risk merchants may need a monthly minimum ($25) to qualify

6. Shopify Payments

Is your ecommerce store hosted on Shopify? If so, using Shopify Payments for your payment processing means you avoid paying Shopify’s per-transaction fee (which can be up to 2%) on top of a payment processing fee.

If you’re using a different ecomm platform, you can use Shopify Lite features on your site.

Pros

Quick application process

No need to integrate outside providers

Cons

Risk of being put on hold, like with other PSPs

Only available in certain countries (including the U.S., UK, Canada)

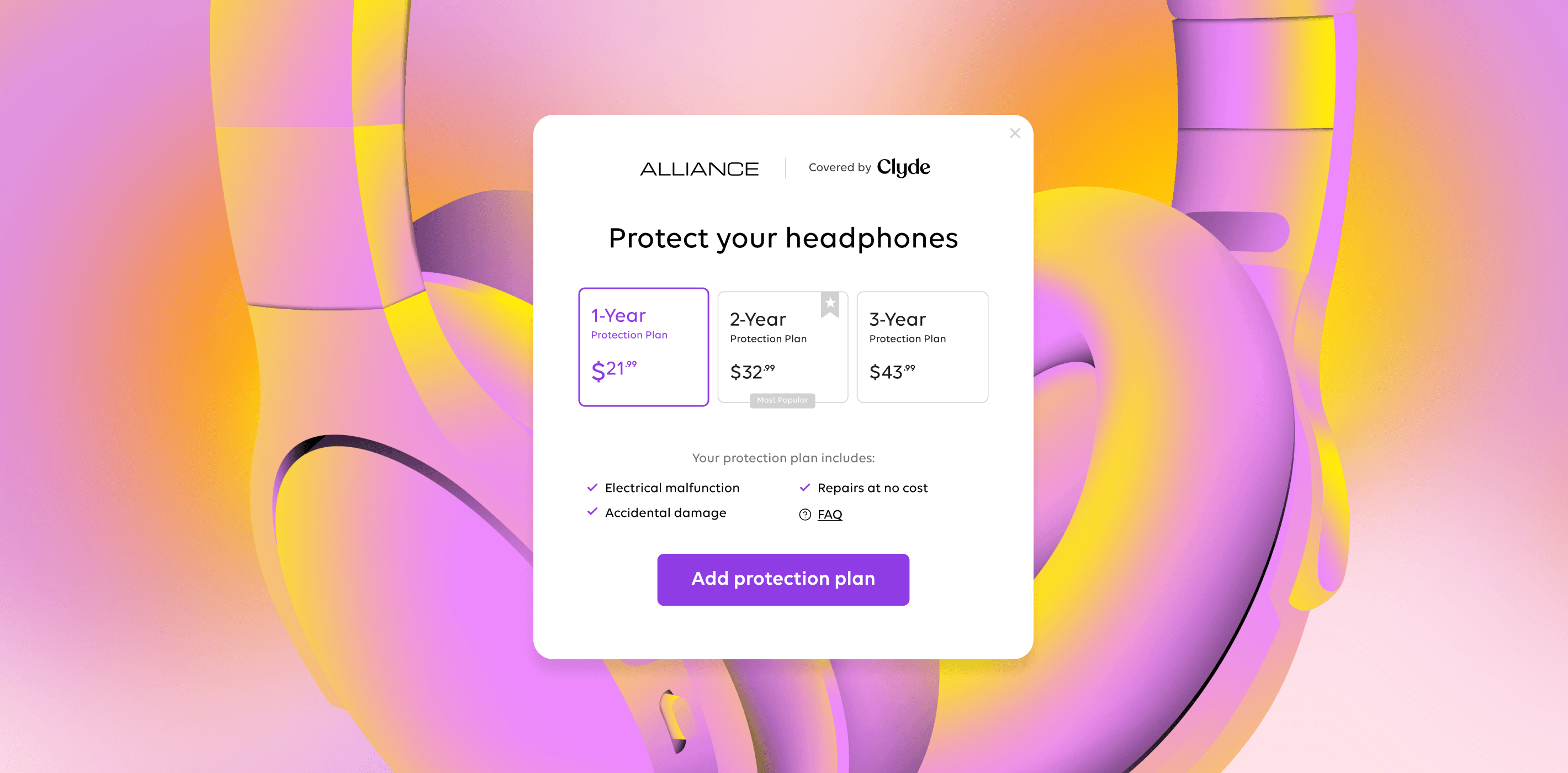

Give Paying Customers Product Security With Clyde

As we explored above, your chosen payment processor doesn’t have to be just a means to an end.

It can be a way of broadening your potential customer base. Or gathering valuable insight on purchasing patterns. Or furthering your brand recognition and engagement.

Great payment processors do more than just receive payments.

Just like great checkout solutions do more than just shuttle buyers through a purchase.

Adding Clyde to your checkout process allows you to boost both average order value and customer satisfaction and trust.

What’s not to love about that?

Set up a free demo to see how Clyde can drive revenue and loyalty for your ecomm business.

SIGN UP FOR OUR NEWSLETTER