Two of the biggest trends in retail over the past five years have been a shift to direct-to-consumer (DTC) selling, and the rise of omnichannel. While the word ‘omnichannel’ may have been used so many times at this point that it risks losing its meaning, there’s a reason it’s so popular. The proliferation of channels through which to purchase has made it crucial for retailers to create an integrated, cohesive customer experience. In addition, a focus on DTC selling—both for digitally native and traditional retailers—has meant higher margins and better data capture for brands.

Many of the ways in which brands can grow DTC revenue and offer better omnichannel experiences have been discussed ad nauseum at this point—from a seamless checkout experience to better personalization, creative fulfillment options, and even augmented reality.

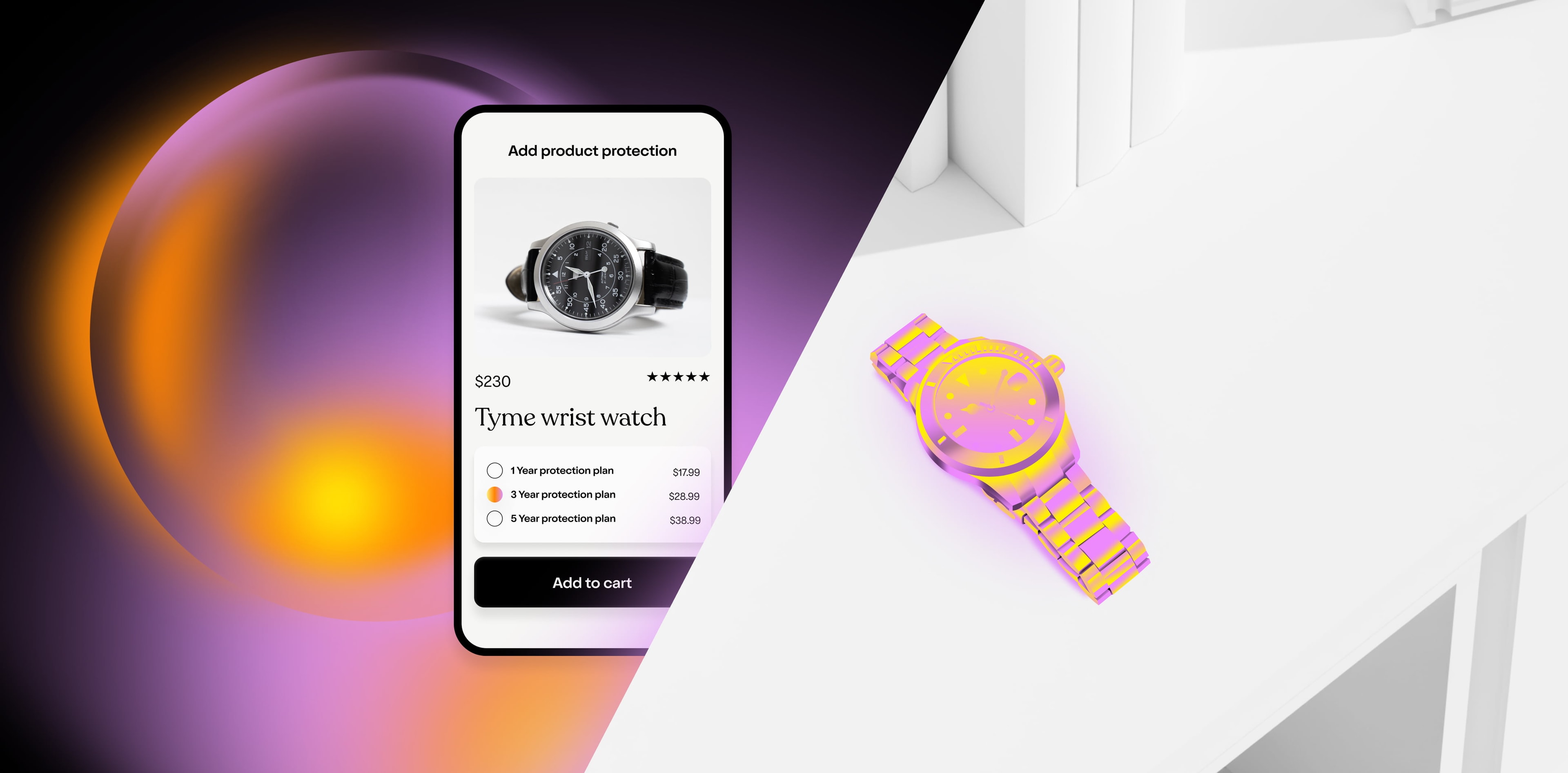

But one that hasn’t yet been talked about as much is the importance of offering customers the option to purchase product protection—both in-store and online. Offering product protection has been a best practice of large, established retailers like Best Buy, Apple, Walmart, and Amazon for decades—in fact, it’s Best’s Buy’s most profitable business line. (See our brief history of product protection here .)

Most consumers will engage with your brand multiple times before making a bigger ticket purchase. According to the eCommerce Foundation’s “United States Ecommerce Country Report,” 88 percent of consumers pre-research their buys online before making a purchase either online or in-store. Creating a positive customer experience during this stage of the customer journey can help you stand out from the competition.

One way to differentiate during the research stage is by offering product protection. At this stage, a customer is more likely to purchase a product of interest from a retailer offering to cover that product against wear and tear and accidents than from one which doesn’t. Simply the option to purchase product protection signals to the customer that a retailer is invested in customer experience and satisfaction.

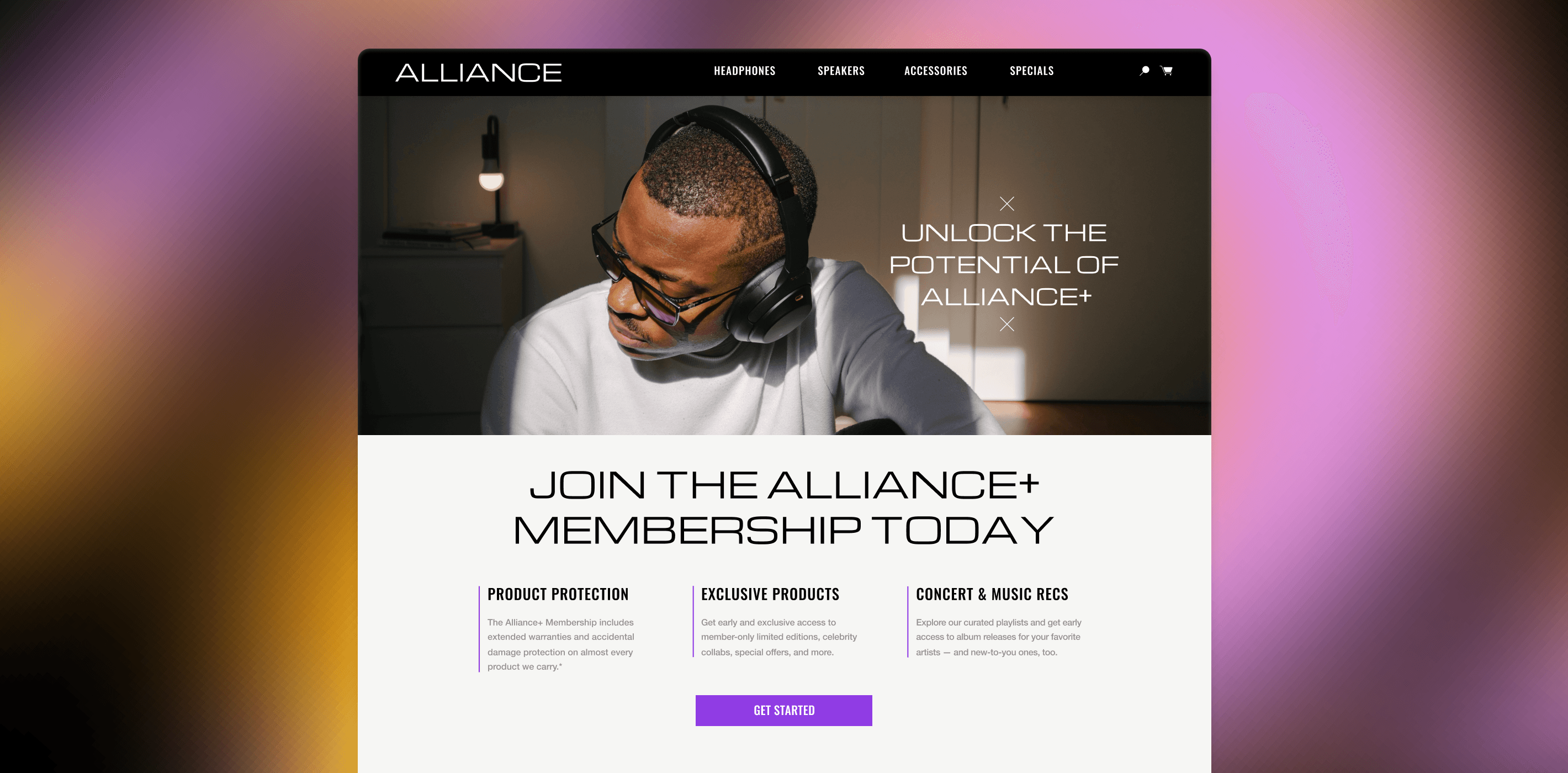

For a positive omnichannel experience, a customer should be able to purchase protection and file claims both in-store and online, as well as for a standard period (e.g. 30 days) post purchase. As more retail companies shift their focus to growing direct-to-consumer revenue, this option becomes even more crucial. For retailers whose products are sold by third parties (e.g. Amazon or Best Buy), the option to purchase product protection could mean the difference between that revenue coming directly to you rather than through a third party.

However, until recently, it’s been extremely difficult for smaller retailers to build a product protection offering. Insurance companies have a hard time onboarding new businesses. Businesses struggle to connect products to plans and to connect plans to their store. And customers don’t understand terms and conditions, or how to make claims. But when protection plans work for retailers and customers, they can make all the difference in cultivating a positive customer experience.

Shameless plug ahead: this is one reason we built Clyde. Clyde’s platform makes it easy for retailers to match their products with the best protection plans and offer them to customers at any touchpoint. What was once only an option for retail giants like Walmart, Amazon, and Best Buy is now a seamless process for all retailers. Check out our documentation to learn more.

SIGN UP FOR OUR NEWSLETTER