Supply chain woes are leading to a 172% year-over-year increase in eCommerce out-of-stock messages.

And the eCommerce field is more crowded than ever, says Shopify , with wholesalers, major retailers, and traditionally in-person-producers all shifting online. With estimates that traditional retail will never claw back the market share it lost during the pandemic, the competition is here to stay.

So with a bevy of sellers to choose from, customers’ expectations are rising. They want more personalization, more sustainable packaging, more beautiful packaging, more dependable shipping, and more timely and direct customer service .

That’s a lot to deal with. If keeping customers is a challenge in an average year, 2021 upped the stakes. For companies dealing with product delays, increased competition, and ever-growing customer expectations all at the same time, retaining customers couldn’t be more important.

Or lucrative.

A Harvard Business School report dug into customer acquisition studies across industries and found that it can cost anywhere from 5-25x more to get a new customer than to retain an existing one.

And that keeping 5% more of your customers can increase profits by 25-95%.

But before you can improve your customer retention rate, you need to know what it is.

eCommerce teams who democratize their data and use it to drive improvements in customer experiences are the ones who will stand out. Do you know your numbers? Do you know what numbers you should even be measuring?

Read on for our guide to the TK retention metrics that matter.

Understanding customer churn vs customer retention

Let’s say you’re a direct-to-consumer dishware company. You want people to keep buying your dishware whenever you come out with a new line, or a new product, or your customers’ dishware needs change. A dishware company will have different expectations for customer retention than, say, a diamond company or a dog food company. (Diamonds being something that doesn’t often get bought, and dog food being something that does; that’s why comparative customer retention rates really need to be benchmarked by industry to be useful.)

If our hypothetical dishware company found out exactly how many customers are returning to do business with them, they would have found their customer retention rate.

If they instead found out how many customers they’ve lost over the same period, they’d be looking at their customer churn rate. Both are important, and they’re clearly related. Fixing the issues that drive churn can help increase retention, for instance. Understanding what drives retention helps you maintain it.

How to measure the top metric: customer retention

Calculating customer retention is pretty simple.

You’ll start with your number of total customers, then subtract the number of recently-acquired customers and divide by your number of returning customers.

It’s important to do this on a reasonable time frame. How quickly does it usually take for you to onboard and successfully deliver goods or services to your customers? Do they often churn out within a week or month or six months? Choose a time frame that’s right for your industry.

Let’s say our dishware company measures their return rate on an annual basis, since their customers don’t buy dishware more than once or twice a year. Their formula might look like this:

(6,000 customers at the end of the year) - (500 new customers acquired since the beginning of the year) / (7,000 customers at the start of the year) = 79% retention rate

8 Other Key Customer Retention Metrics and KPIs Worth Tracking

Customer retention rate is a great headline number for wake up and stare at every morning. It’s like the Net Promoter Score (NPS) of retention metrics. But there are others worth knowing, too, including:

1. Customer Lifetime Value

How much is a given dishware-buying customer worth to your company over time? Customer lifetime value, or CLV, drives the long-term success of a business.

How to calculate it

Start with your customer’s average purchase size and multiply it by the number of purchases they make per year and the number of years they stay a customer.

Our dishware company might calculate theirs like:

($200 AOV) x (2 purchases per year) x (4 years average customer relationship) = $1,600 CLV

Tips for improving it

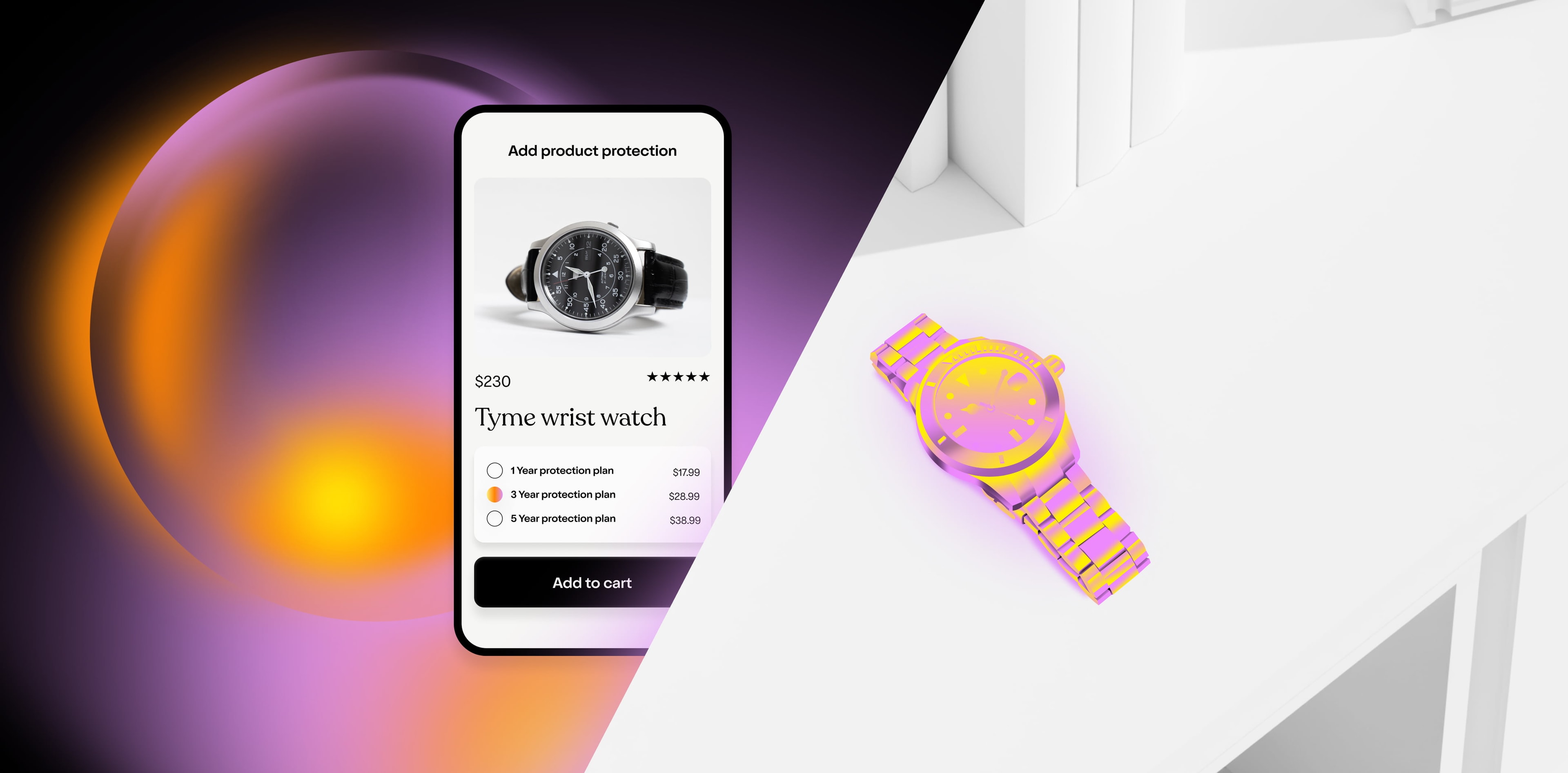

Clyde users tend to be obsessed about their customer experience—it’s why they wanted to offer peace-of-mind-granting extended warranty programs in the first place—so we’ve seen lots of ways to increase your customer lifetime value . Here are a few to start with:

Regularly solicit customer feedback, like with an automatic review platform, and prioritize improvements based on any negative feedback

Provide value to your customers outside of your direct product, like with educational or inspirational materials or media

Resolve issues quickly via a dedicated customer success team

Introduce upselling and cross-selling into your checkout process

2. Customer Acquisition Cost

How much money does it cost your company to successfully get a new customer?

How to calculate it

This one needs marketing department involvement. You’ll take the total marketing cost, which will be made up of salaries / wages paid to your marketing team and any consultants that you have on board; tool costs for any email services, CRMs, ad platforms, and other marketing tools used; and advertising spend, which will include traditional, digital, and any other kind of advertising or publicity projects — and then divide it by the number of customers acquired.

Our dishware company would calculate theirs by taking:

($250k salaries for 3-person marketing team + $100k in consultant services) + ($22,000 annual cost of tools and software) + ($100k advertising budget) / (500 new customers acquired) = $944 CAC

Tips for improving it

Spend less money acquiring customers. Sounds easy, right? You can combat rising CAC s by:

Implement a referral program to unlock an army of (free!) microinfluencers that drive acquisition without driving spend

Cut your advertising budget and focus instead on the one or two platforms that best perform for your specific business, as explored in HubSpot’s great guide

Automate manual (read: expensive) marketing tasks, like formatting emails, so you can streamline your team over time

3. Value to cost ratio / LTV:CAC

Once you know exactly how much a customer is worth to your business over time and exactly how much it costs to bring said customer into the door, you can get to a really important metric for the health of your business: your value to cost ratio.

If your value to cost ratio is less than 1, it means you’re losing money to acquire customers. You’re spending more than they’ll end up being worth, and that’s not at all sustainable.

If it’s just above 1, you’re slightly profitable, but not close enough to the growth levels needed to make a real difference.

If that ratio is between 2 and 3, well done. 3 is the benchmark many industries look for, since it means you’re making more than enough revenue to keep acquiring at your current pace or to even improve it.

If your ratio is above 3...you’re absolutely crushing it and are on track for big thing$. Kudos!

How to calculate it

This one is simple: just divide your LTV by your CAC.

Based on our dishware company example:

(LTV of $1,600) / (CAC of $944) = 1.7

That’s a decent value to cost ratio, but our company needs to get its LTV up or its CAC down over time if we really want to stick around and enjoy growing margins over time .

Tips for improving it

This really just requires working on the driving forces for both of those two main metrics! Keep in mind that sometimes improving something like LTV means thinking outside of the box to provide a service, an option, or an experience that customers cannot get somewhere else. For instance, take this example from a successful DTC beverage company’s thread on how they grew their subscriptions:

4. Revenue churn rate

This metric lets you know what percentage of revenue you’ve lost from your existing customers over a given period, and it puts a number to the scale of the annoyances or disappointments faced by your customer base. Revenue churn can be driven by cancellations, returns, or the end of a buying relationship, and digging into it can help you get ahead of issues.

How to calculate it

Take your regularly recurring revenue at the beginning of a period, like a month, and subtract your regularly recurring revenue at the end of the month, then divide by your start-of-period number.

Our dishware company might see a RCR of:

(start of month MRR of $200,000) - (end of month MRR x $210,000) / ($200,000) = -5%

In this example, having a negative revenue churn rate means that you’ve made more new money from existing customers than you have lost it. If you released a new product and then saw your RCR spike, though, you’d know that that product wasn’t performing with your core customer base—and that you needed to intervene.

Tips for improving it

Revenue churn rates work best for companies who want to drill into specific product offerings. (Measuring it across an entire company’s product line often isn’t that helpful, since you can’t identify what products are driving changes.) If you don’t like your RCR, consider:

Focus groups to test out new products before launch, including marketing messaging around them

Post-churn surveys to understand why a customer left

5. Customer churn rate

This number is the percentage of customers you’ve lost during a given period, oftentimes a month. It’s different from revenue churn rate as it looks not at how much money you’re bringing in, but how many people are buying from you. You could see a spike in customer churn (you’re losing customers) even if you see no problems with your revenue churn (you’re still making the same or more money per month), especially if you did something like release a new, more expensive product line that was of no interest to one segment of your customer base, but got other existing companies to spend more money per order.

How to calculate it

Take your number of customers at the start of the period, and subtract your number of customers at the end of the period, then divide by that first number.

Our dishware company might see a customer churn rate of:

(6,000 customers at start) - (5,800 customers at end) / (6,000 customers at start) = 3%

Tips for improving it

A 3% customer churn rate isn’t bad at all. A marketing consultancy found that average churn rates vary by industry, but fall between 5-7%, with rates spiking in consumer goods, at 9.6%, and falling in SaaS, at 4.8%. But if you see your customer churn rate hit more than 8%, you’ll want to understand what’s driving it and:

Redesign key processes, like checkout or returns, around customer feedback

Offer more timely customer assistance, from live chat to phone to email ticket service

Revisit your pricing, especially if you’ve recently considered an increase

6. Product return rate

This number applies only to companies that sell physical things, like our dear dishware company. It measures what percentage of units sold end up being returned.

Returns can be driven by a variety of factors, including dissatisfaction, fit or quality issues, or product failures. (In that last case, if you offer an extended warranty program, you can actually build customer loyalty even in the case of a product failure and capture the next sale.) Understanding what’s behind your customers’ returns will help you improve your customer retention over time.

How to calculate it

This is a simple one: take your number of units returned and divide it by the total number of units sold. Just make sure you’re looking at both numbers over the same timeframe, like month, quarter, or year.

Our dishware company might see a product return rate of:

(150 units returned) / (4,000 units sold) = 3.8%

Tips for improving it

A 2021 Shopify report looking at eCommerce returns found that online purchases are returned around 11% of the time, with apparel coming in at one of the highest rates (12.2%) and pharmacy purchases at the lowest (1.6%). Around 10% of returns are driven by defective or “not as described” products, says the report. And January is peak season for returns, driven by post-holiday shopping fallout.

To get ahead of those trends, companies can:

Make product information easier to find and more accurate. For apparel, this can include using different-sized models and sharing their specific dimensions; for electronics, it can include comparative photos and commonly asked questions, for instance.

Use augmented reality technology to let customers “try out” products before they buy, like a Shopify example client who build 3D versions of their dog crates so customers could check out the sizing on the crates before buying, which ended up cutting their return rate by 5%

Improve your packing and shipping processes, from using inventory management software to make sure you don’t sell out-of-stock items to adding an extra inspection step to catch damaged product before it goes out the door

7. Repeat purchase ratio

This metric measures the percentage of your customers who return to buy from your company again—and is often a quick at-a-glance way to check your customer loyalty. This number can be especially helpful when broken up by demographics across your different buyer personas.

Maybe under-30s regularly come back to buy more from our dishware company, but older people don’t, so our email marketing campaigns focused on completing your set should really be dedicated to that younger subset.

How to calculate it

Take your number of returning customers and divide it by your number of total customers. You can do that over any time period, from weekly to annually.

For our dishware company:

(1480 returning customers) / (6,000 total customers) = 25%

Tips for improving it

Segmentize your marketing efforts by key customer bases

Make the most of transactional emails (including post-purchase emails !)

Offer incentives for a second purchase, like a free gift or a discount

Go even farther and launch a loyalty program with action-based rewards for repeat buyers

Try cart abandonment emails that encourage people to pull the trigger on a new purchase

8. Time between purchase

This number lets you know how long it takes a customer to return to buy from you again. It gives you useful data on their appetite for their product (as well as how happy they are with it), along with letting you know the right cadence to use for marketing pushes to re-hook them for future purchases.

Keep in mind that this metric, like many others on this list, depends entirely on your industry. If you sell a monthly subscription box, your expectation is likely that happy customers would come back every month to buy another. If customers are waiting 8 months to get a second one, well, either you’ve misjudged their use for or interest in your product, or they’re unhappy with the price / quantity / quality. If you sell expensive leather boots, it would be unreasonable to expect people to buy a new pair from you every month, and a once-every-two-years purchase rate might be exactly what you’re looking for.

How to calculate it

Measure (using a CRM, likely) each customer’s individual purchase rate, or how long it takes them to purchase another item after purchasing their first. Then divide the sum of individual purchase rates by your total number of repeat customers to find the average.

For our dishware company:

(68 days + 92 days + 127 days + 105 days + 99 days +...[1475 other individual time between purchase numbers]) / 1480 repeat customers = 98.2 days between purchases

Tips for improving it

Send custom email campaigns, like “We miss you!” or “New product we think you’ll like!” emails, utilizing personalization whenever possible

Use elements of gamification to encourage customers to keep coming back to your products or pages, like letting them unlock discounts for trying a new product line, leaving a review, or posting about their purchase

Offer off-cycle promotions on the cadence you’d like your time between purchases to be

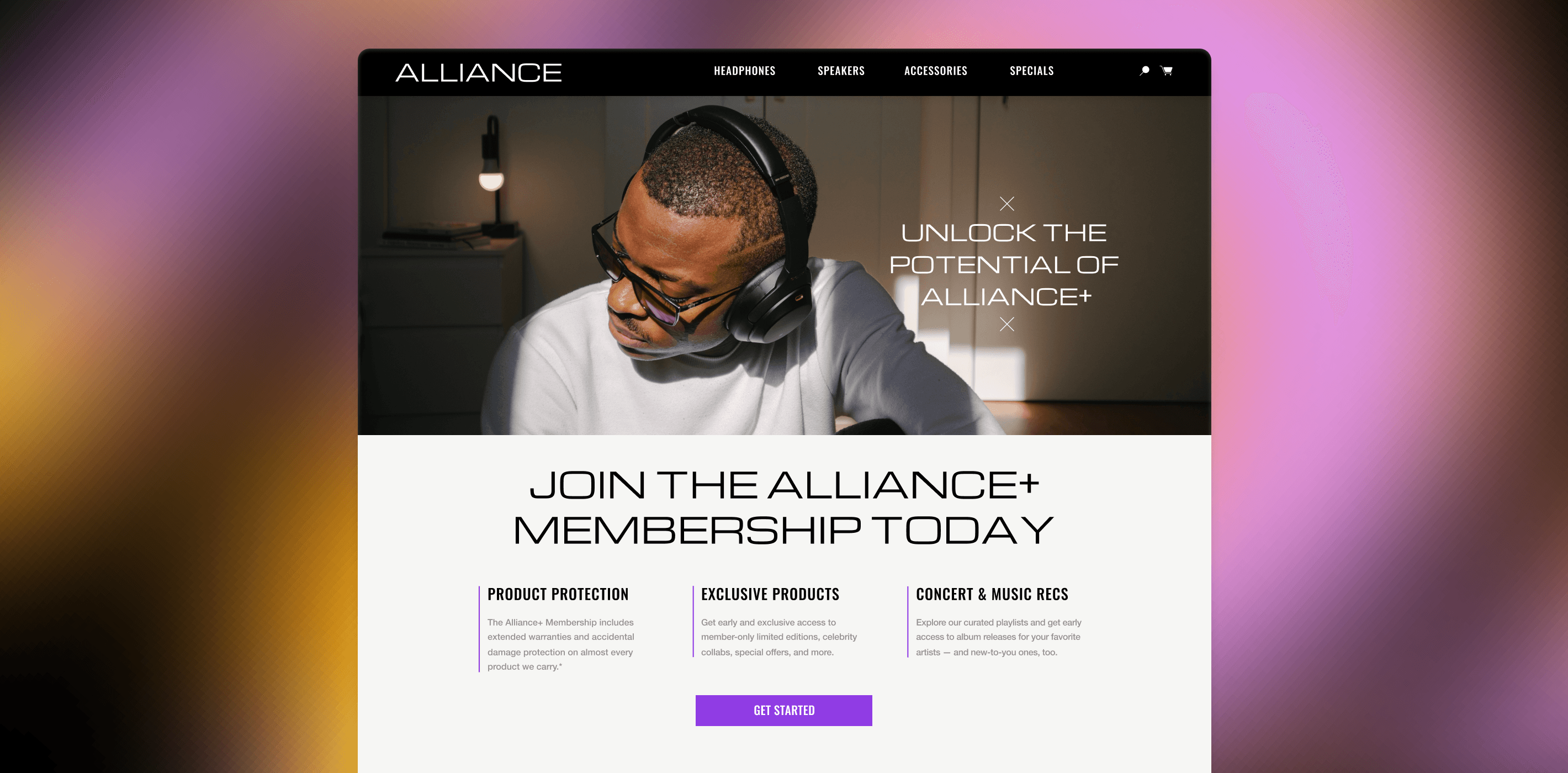

Give Customers What They Want With Clyde’s Warranty and Product Protection

Happy customers return, and an easy way to make your customers happier across the board is to offer best-in-class purchase protection on every sale.

Clyde’s platform is here to do that. Get set up in minutes, with a dedicated support team, to start seeing your average order values click up alongside your customer satisfaction rates.

Set up a demo today and see how Clyde can help with customer retention.

SIGN UP FOR OUR NEWSLETTER