Southwest Airlines’ is 71. Verizon Fios’s is 24. Airbnb’s is 43, Apple’s is 51, and Ritz Carlton’s is 70.

Those numbers are those companies’ NPSs, or Net Promoter Score, and I can guarantee that the CEOs of those companies think about their number on a regular basis.

Companies in every industry (and over two-thirds of the Fortune 1000 ) track their Net Promoter Score, a measure of customer loyalty. But different industries see different results. Although Verizon’s NPS is significantly lower than Southwest’s, they both lead their respective industries, per Satmetrix’s 2020 report on Net Promoter benchmarks .

Though the methodology behind the NPS is open-source and widely-adopted—all you have to do is ask your customers one question!—there’s an entire sub-industry of customer research firms and software services that exist to help companies gather, analyze, and act on the insights from their NPS.

Like with any metric dependent on customer responses, though, even the highest Net Promoter Scores are only including insight from a small section of a given company’s customer base. The future of the ubiquitous loyalty metric might look a lot less like email surveys and a lot more like AI-enabled predictions.

But more on that later! In this blog, we’ll cover:

What is NPS?

How is NPS calculated?

What’s a good NPS?

How is NPS used?

And what’s the future of NPS?

And we’ll also do our best to not ever say the phrase “NPS score” (the “score” part is in the name, a la “ATM machine!”). But no promises.

What is Net Promoter Score (NPS)?

Net Promoter Score is a customer loyalty and satisfaction metric that measures how likely people are to recommend a company to their friends.

It’s pretty much just that one question: How likely are you to recommend our [company, product, service] to a friend or colleague?

Respondents can choose from an 11-point scale ranging from 0, or not at all likely, to 10, or extremely likely.

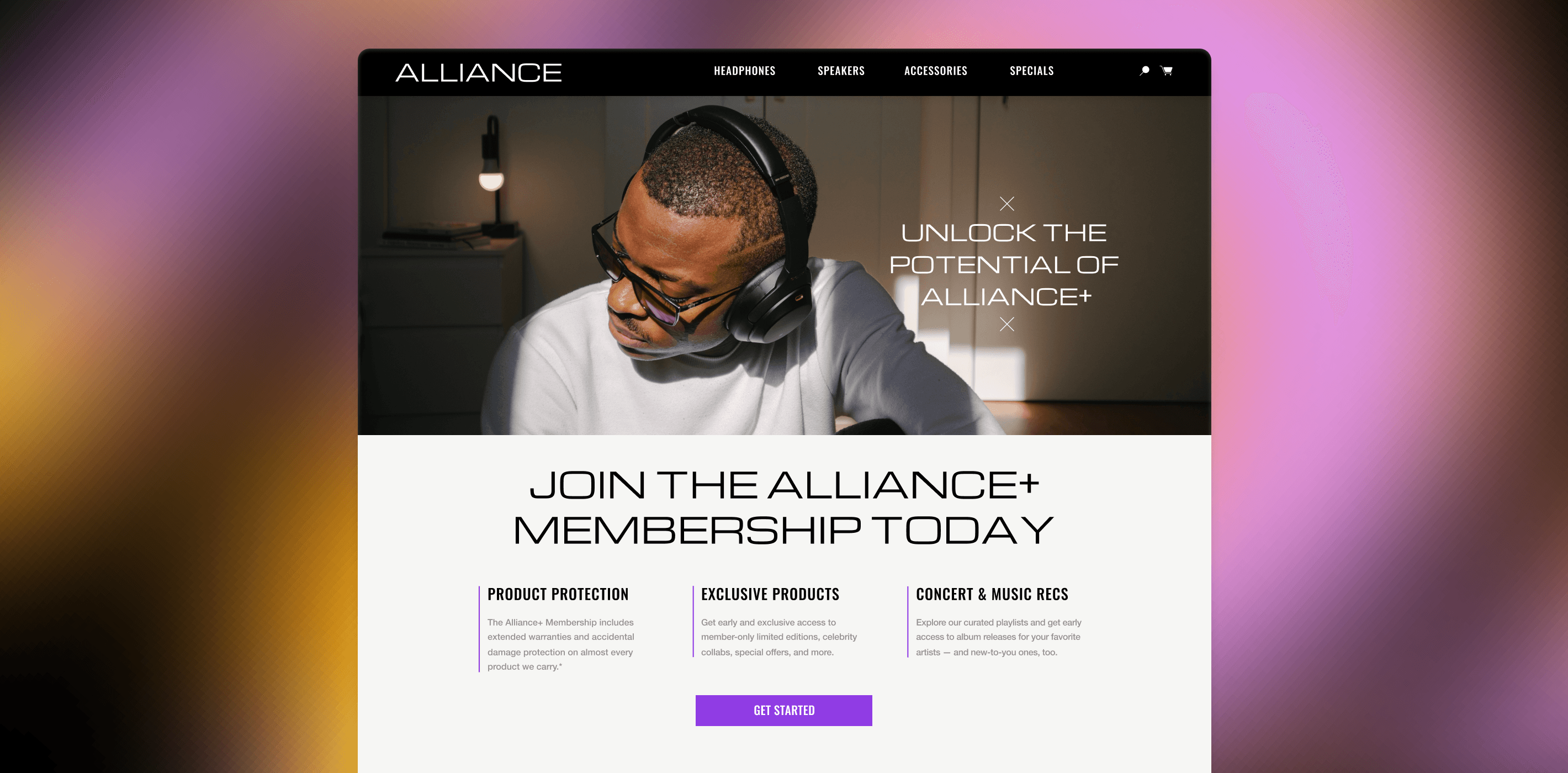

You’ve probably seen them after buying a product or using a service:

Sometimes companies will go beyond that first question and add questions like:

What influenced your rating?

What could we do better?

What is your age / gender / location? (Or other demographic questions, if that information isn’t already collected elsewhere.)

The Net Promoter Score was invented by, and is a registered trademark of, Bain & Company, Inc., Fred Reichheld, and Satmetrix Systems, Inc. It was popularized by Reichheld’s 2003 Harvard Business Review article “The One Number You Need to Grow ,” which argued that NPS was the most helpful indicator for predicting future growth.

How is NPS calculated?

A company’s NPS is calculated by subtracting the percentage of detractors from the percentage of promoters.

Those groups are determined as follows:

If they respond with a 9 or 10, they’re promoters, or people who will share your business with others and be recurring customers themselves. These are the most valuable customers to have, loyal and vocal.

If they respond with a 7 or 8, they’re passives, or people who don’t have any major issues with your company but aren’t likely to actively endorse it, either. They’re satisfied but unenthusiastic.

If they respond with a 0, 1, 2, 3, 4, 5, or 6, they’re detractors, or people who are unlikely to recommend you to others and may speak negatively about you. They’re damaging to your brand, So if a company surveys their customers and 70% of respondents gave the company a 9 or 10, 10% gave them a 7 or 8, and 20% gave them scores between 0 and 6, the company’s NPS would be 60. (The passive percentage gets left out of the calculation.)

To get a score of 100, every single customer would have to be a promoter. The lowest score possible is -100, if every single customer is a detractor.

What’s a good NPS?

There’s no one end-all benchmark for NPS; it depends on a company’s industry.

For instance, industries that are full of churn—like internet service providers—enjoy an average NPS of just 1, whereas online entertainment companies see an average score of 43, according to Satmetrix’s 2020 report .

Generally, a score over 70 is excellent and means that a company’s customers really love them and are providing tons of word-of-mouth referrals. A score above 30 is a great one, and a score between 0 and 30 usually suggests that there’s room for improvement.

Unless you’re a cable TV provider, that is, in which case Verizon Fios’s score of 24 is looking pretty darn good versus an industry average of 1.

(See why industry benchmarking matters?)

How are NPSs used?

Net promoter scores are used by companies in a few ways:

To predict business growth

To benchmark success in a crowded market

To track customer loyalty

To rally employees, from product to sales to customer success teams, around a key metric of success

When NPS surveys include qualitative follow-up questions like “Where could we improve?”—and then companies act on those insights, or “close the loop,” they can also help with:

Identifying churn

Improving products

Retaining at-risk customers

That’s why it’s important that companies not just ask for customer feedback after a successful interaction, but rather at several key points of the customer journey.

If a company can figure out who their detractors are and what’s driving their experience, they can make targeted changes to improve not just their NPS but their overall business growth.

Where are NPSs headed?

When that HBR article was first written and NPS was the hot new metric, companies might’ve polled their customers every quarter at most.

But with eCommerce’s treasure trove of customer touch points and the ubiquity of email and text check-ins, there are plenty of opportunities to get real-time data on customer satisfaction—and plenty of software companies set up to do just that. (Though as we explored in our whitepaper The Touchpoint Trojan Horse , whether customers are opening and actually responding to all those emails is another topic entirely.)

From AskNicely to Gainsight to Delighted and more—including Bain and other big consulting firms—there are dozens of companies that can automate the way a business updates, analyzes, and improves its NPS. Common features include qualitative response sorting and tagging, daily survey results (from different customers—no one wants to be asked every day if they like a product), and over-time analysis.

Big players like Qualtrics can compare NPS to other key metrics like average handling time to determine how individual customer success employees are performing. They can even build a model that incorporates customers’ NPS answers and demographics into an automatic predictor of churn, identifying at-risk customers and giving companies a chance to right their wrongs even before they identify themselves.

That’s already happening. In the future, NPS surveys might be obsolete. As AI transcription software gets better and better and biometric data becomes more available, argues that Fortune report , companies might be able to track customers’ sentiment on phone calls or chat messages through their tone of voice, word choice, breathing style, pulse, amount of time spent talking or typing, or other metrics, and no longer need to ask them directly.

Even then, it will likely still be humans who will respond to the qualitative feedback customers are sharing, so customer success jobs are safe—and so are those dozens of companies selling NPS software.

And now our final question: How likely are you to recommend this blog to a friend or colleague?

SIGN UP FOR OUR NEWSLETTER