When I lived in Argentina, it took me a while to get used to the idea of pagando en cuotas, or paying in monthly installments. You could pay for a couch, a TV, a pair of shoes, or even a steak dinner over 3, 6, 12, or 24 installments . It was a common option in a country whose inflation rate hit 54% in 2019, a 28-year-high .

(And we’re here in the States complaining about a 7% rate of inflation! Though admittedly, it is the highest we’ve seen in this country in 39 years .)

But I soon recognized that Argentine cuotas were a staple of the economy. They were a way to help everyday people access cheap credit, better manage their cash flow, and spread out the risk of hyperinflation. At the same time, they allowed vendors to secure a sale and stay competitive.

It’s not just Argentina. Buy now, pay later (BNPL) financing is already a huge industry in Australia, the U.K., and China . And in recent years, BNPL options have grown in popularity in the United States.

A 2022 study found that 6% of all online spending was financed by BNPL platforms in 2021. That number is expected to grow to 13% by 2025.

Buy now, pay later, also called lending at point of sale, is here to stay. Here, we’ll explore where it came from, how it works, and what it allows merchants—and consumers—to do.

Buy Now Pay Later: Who’s it for?

Previously, financing was reserved for big-ticket items. A car was bought with the help of a car loan. A house with the help of a mortgage. The seller and the buyer got what they needed, and the bank that provided the financing got a cut, too.

BNPL works a little differently.

What is BNPL?

It’s short-term financing. Consumers can use these installment loans to pay off purchases in weekly, biweekly, or monthly installments. Payments are often interest free for a set period of time—like three months—before high interest rates kick in. Just like a credit card, retailers pay a fee when consumers pay via BNPL options.

Buy Now Pay Later for Businesses

Retailers are in the business of finding buyers for their products and then convincing those buyers to make a purchase. Offering flexible payment options that align with consumer preferences helps with both parts of the equation. Per McKinsey , 60% of consumers are likely to use BNPL / point-of-sale (POS) financing over the next 6-12 months.

But businesses thinking about offering BNPL options have to consider both the pros and the cons.

Pros

Boost to conversion rates. If your conversion rates are plummeting, it could be because customers get sticker shock at check-out, or because they see they aren’t able to pay their preferred way. Offering BNPL options can help convince customers to pull the trigger on a purchase, increasing conversion rates by 200-300%, says McKinsey .

Increase in AOV. A study by BNPL option Affirm found that average order values were 85% higher when customers used their financing options.

Happier customers. We know that offering purchase protection can boost customer loyalty and satisfaction . Offering flexible payment options can, too. 87% of consumers between 22 and 44 want to be able to break large purchases into monthly installments, per pymts.com .

Cons

Additional costs. Banks, credit providers, and other lenders charge retailers a fee every time a customer uses their BNPL services. Per a 2021 report from the Federal Reserve , BNPL merchant costs range from 1.5-7%, whereas debit or credit card transactions usually cost between 1-3%. Looking at the fine print will help retailers decide if it’s worth it.

Integration issues. Offering a new option at checkout could disrupt your current checkout flow. Retailers considering BNPL partners will need to consider how quickly and easily they can integrate the option onto their site.

Brand risk. More on this later, but some consumers see BNPL options as predatory. An LA Times headline sums it up: “Sleek, new credit apps target a young generation already drowning in debt.” An op-ed on Windows’ Edge browser and its BNPL integration is similarly titled “Microsoft Edge integrating buy now, pay later is predatory and disappointing.” Brands may not want to associate with the practice.

Buy Now Pay Later for the Customer

The fast-climbing numbers of American consumers using BNPL options proves that they’re popular. Interestingly enough, McKinsey’s research found that “while the average credit score of consumers using these solutions is under 700, this has less to do with bad credit history and more to do with relatively thin credit files.”

That means that BNPL is becoming a helpful option for buyers making purchases online, which is at least 13% of all sales .

But customers considering BNPL options should be familiar with both the pros and the cons.

Pros

Free credit. This is the main benefit of BNPL for consumers. If buyers take advantage of BNPL providers’ interest-free periods, they can get free credit without having to wait to receive their purchase (like a typical layaway option). That credit can help them manage their cashflow or expand their investment options. For example, someone buying a $600 TV via three $200 monthly payments could spread that big purchase out, making sure they had enough to cover utilities. Or, after making their first payment, they could invest the remaining $200 payments and get a return on them for 29 and 59 extra days before having to pay it.

No hard credit check. BNPL options are easier to qualify for than a credit card, per the Motley Fool , and providers don’t run a hard credit check before approving you, which helps with your credit score.

Cons

High interest rates and late fees. There’s always a catch. BNPL’s free credit jumps to very expensive credit if a buyer misses a payment. APR can go as high as 30%, sometimes applicable from the initial date of the loan, and late fees range from $0 to $10, per Nerdwallet .

Risk of overspending. If BNPL options mean higher AOV for retailers, that means higher spend by consumers—not all of whom might be ready to make it. A LendingTree survey of more than 1,000 American consumers found that 67% of people who had used BNPL services said that those services caused them to spend more money than they otherwise would’ve. Nearly half said they wouldn’t have made the purchase without the option to finance.

Less protection. Purchases made with a credit card are protected by consumer credit laws. For example, if a buyer never got a computer they ordered, they could call their credit card company and get help immediately, with a resolution within two billing cycles. BNPL lenders aren’t held accountable to regulatory laws in the same way. (Yet.)

Popular Buy Now Pay Later Services and Apps + How They Work

Considering the popularity of their product, BNPL service providers are only going to continue to grow. Here are some of the most popular types of providers in 2022:

Afterpay and Klarna

Both Afterpay and Klarna work as “Pay in 4” models, which means they finance small-ticket purchases, usually less than $250, via 4 biweekly installments. Popular vertices include apparel and footwear, fitness, accessories, and beauty, per McKinsey .

Both offer 0% APR, 4 installments due every 2 weeks, and late fees of $7-8.

Zip and Sezzle work similarly.

Afterpay and Klarna both charge retailers 4-6% and $0.30 per transaction.

Affirm

Affirm is an off-card financing solution. Like other similar solutions, it’s most popular in verticals like electronics, furniture and home goods, sports equipment, and travel, per McKinsey . Average purchase size is $800, with loans lasting 8-9 months on average.

It works by charging consumers an APR, which is sometimes subsidized by the merchant, that is often lower than a credit card.

Payment schedules vary, but are between 6-12 months, with a 15-30% APR, based on consumer credit. Affirm charges no late fees.

For merchants, Affirm charges 5.99% and $0.30 per transaction.

Splitit

Splitit is a fintech company that helps buyers use existing credit or debit cards to make purchases. Their system puts a hold on the credit card and charges the card every month until the payment is completed. It uses the credit the buyer already has, without giving buyers an additional loan (and thus without asking for an additional application or credit check).

Per McKinsey , card-linked installment plans like Splitit help with purchases of an overage $1,000, and are more popular with higher earners.

Splitit charges no interest or late fees to buyers and offers terms of 6 to 24 months.

For merchants, Splitit’s fees start at 1.5% and $1.50 per installment.

Is Buy Now Pay Later Right for Your Business? 4 Questions

As a business owner, you know that there are, at any given point, dozens of things you could be doing to help improve your bottom line and please your customers.

How do you know if investing in setting up a BNPL option is the right thing to focus on?

Ask yourself these 4 questions to get started.

What Are My Margins?

Your margin is the price of your product minus the expense of getting that product sold. Can you afford to spend another $1.50 or $0.30, per the per-transaction charges listed above, to sell your product?

Those numbers aren’t huge. And it’s not like you’d be losing half of your margin on a $5 t-shirt; BNPL tends to be used for purchases of $100 and up.

But you do have limited margins to cut into, and you need to think about the opportunity cost. Could that money provide more value offered to the customer as a straight-up discount? Or invested in additional marketing?

How Do Transaction Costs Compare?

You’re used to paying fees for each credit card transaction. Are the fees of the BNPL platform you’re considering comparable?

According to Nerdwallet , credit card processing fees cost businesses 1.5-3% of the transaction’s total. Klarna’s fee, starting at 4%, is only slightly above that. But if you go with Affirm, you might pay double that, at 5.99%.

Make sure you understand what costs you’d be facing based on your industry and average purchase order.

Does The Practice of “Buying Now and Paying Later” Fit My Brand Identity and Values?

It’s not just the LA Times . Forbes columnists , Reddit posters , and Wired reporters are all talking about the problematic nature of BNPL apps that may push consumers into buying more than they can afford.

The issue isn’t black and white. As explored above, BNPL platforms come with plenty of pros, and they can be hugely beneficial to savvy consumers who understand the fine print and steer clear of late payments.

But since consumers can be caught unawares, and end up in debt, there is definitely an ethical component to consider. Is offering an BNPL option right for you, your brand, and your typical buyer?

As an Atlantic columnist reported , “‘That line between helpful and predatory can be really blurry…what may be predatory to one type of customer is actually a very good solution for another type of customer.’”

What’s the Risk of Potential Future Regulations?

No BNPL company on the market today is profitable, reports the Financial TImes , and that’s largely because the sector isn’t very regulated. New players are entering and trying to grab a piece of the pie, jacking up acquisition costs for competitors.

But BNPL platforms and businesses alike have to stay wary, because regulations are coming. The next “credit event” will result in “material amplification of pressure from government and regulators,” per the FT. Profit margins will be cut, which means higher prices for retailers, on top of the risk of bad press.

Alternative Differentiators to Offer Instead of Buy Now, Pay Later Financing

If point-of-sale financing isn’t right for your brand or business, but you still want to invest in improving your AOV and your customer satisfaction, try one of these tactics:

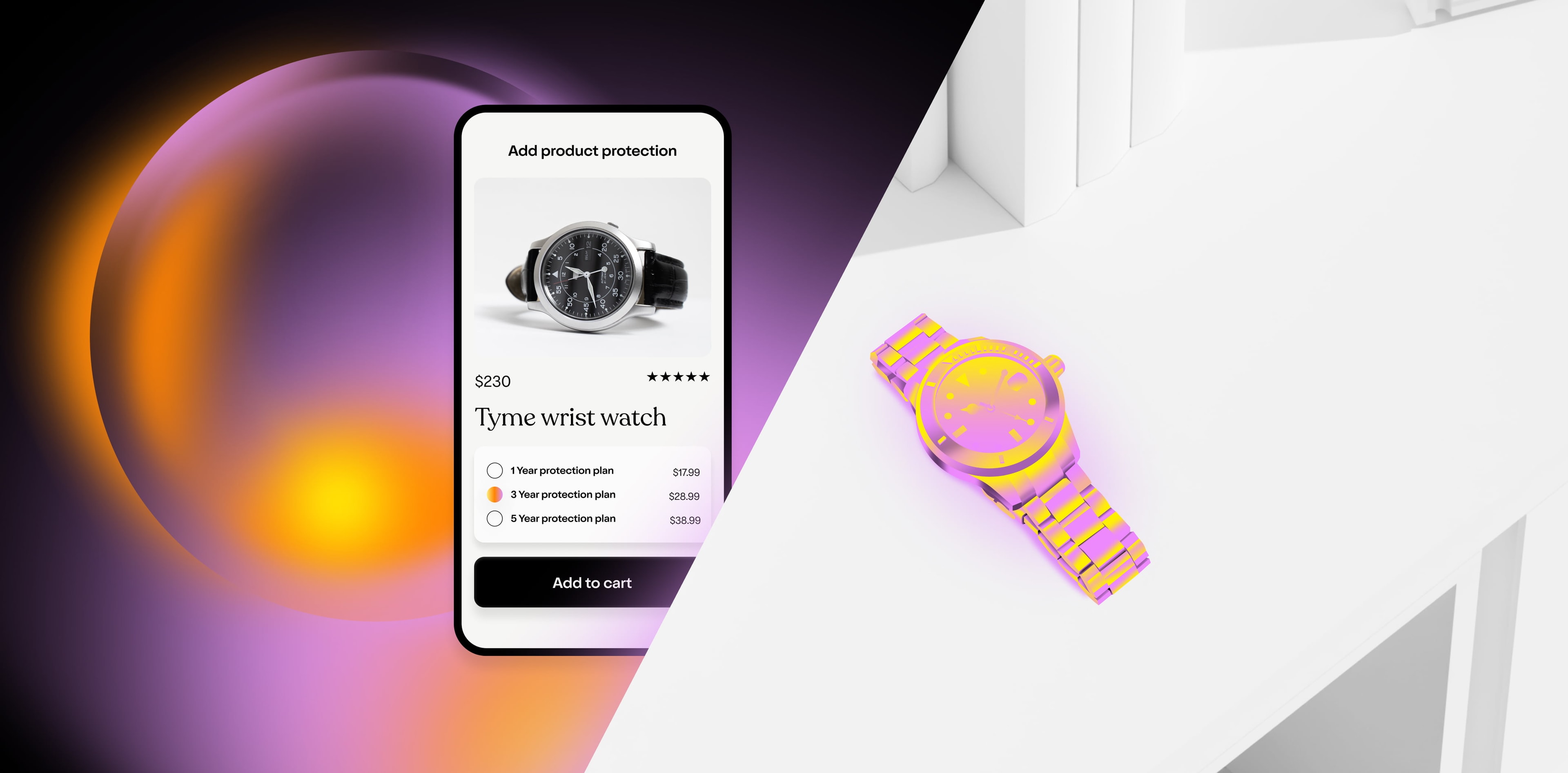

Implementing other microservices , like a better search tool, product protection options, or an easier checkout, that can improve conversion rates and customer experience without having to build brand-new tools (here are 4 great ecomm plug-ins aside from BNPL)

Offering free shipping, which is consumers’ number-one favorite benefit

Invest in excellent customer service, which can create genuine brand advocates

Optimize Your Checkout Experience with Clyde

Customers who choose BNPL options do so for two reasons: it derisks the purchase and it helps them stretch their money.

Offering product protection does both of those things, too.

Clyde’s extended warranty program gives consumers extra peace of mind by protecting their purchases in the case of product failure or accident. It turns a purchase into an investment, ensuring that they’ll get a repair or replacement in case of issue, instead of just losing whatever they spent.

And it gives retailers a way to increase profit without dipping into their margins.

SIGN UP FOR OUR NEWSLETTER