Costs related to customer acquisition were rising before the pandemic, and just like our growing number of quarantine-induced hobbies, they’ve only continued to rise.

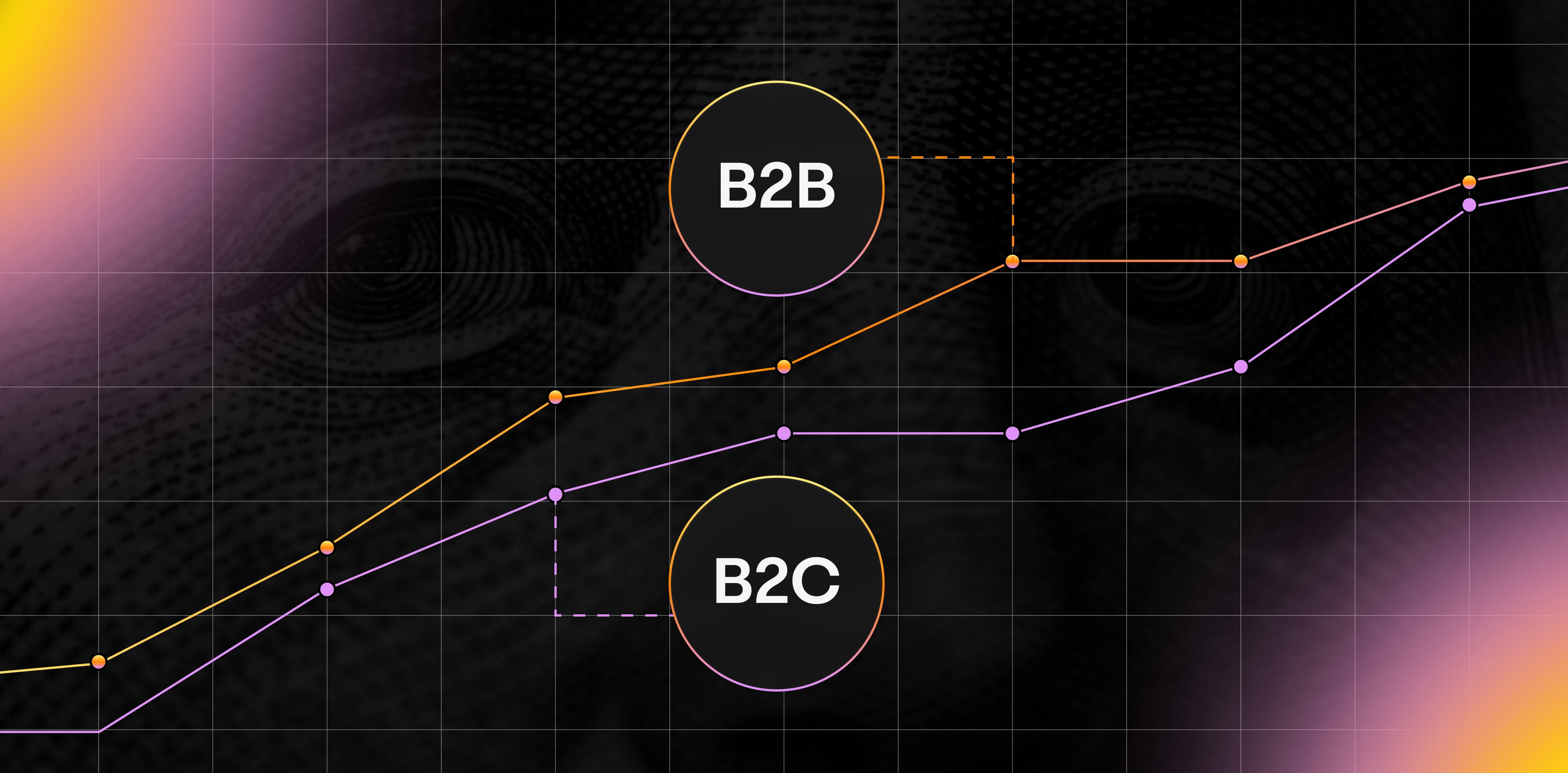

Subscription analytics software company ProfitWell, who looked at nearly 1,800 different B2B and B2C subscription companies, found that customer acquisition cost is nearly 70% higher for B2B companies and over 60% higher for B2C companies than it was just six years ago:

Here, we’ll explore why customer acquisition costs are rising and how the pandemic is affecting them, then share three ideas for acquiring and retaining customers that don’t require you to overdraft your marketing budget.

What is CAC and why is it growing?

Your customer acquisition cost (CAC) equals your marketing costs divided by the number of customers acquired.

If you ran a lemonade stand and spent a grand total of $10 on marketing—hello, poster board and puff paint—and served 20 customers, your CAC would be $10/20 or $0.50/person. That’s extremely low! But you can’t judge a CAC by its value alone. What’s the average customer lifetime value of your product? Or in other words, once you get a customer in the door, how much is that relationship worth over time?

For context, a 2013 book on marketing estimated CACs across various industries to be the following:

Travel: $7

Telecommunications: $315

Ecommerce: $10

Financial: $175

If you use a travel site like Priceline to book a $200 flight that nets Priceline $20 in commissions but never return, that $7 CAC suddenly doesn’t seem so cheap. By comparison, a cell phone provider may spend over $300 to get you as a customer, but they often keep you as a customer for years and years. Those $75/month service fees and pricey equipment upgrades, net the provider thousands of dollars over time.

CAC has grown massively over the last few years for a few reasons:

More channels to make content for. You’ve have, in no specific order, the following methods and platforms to reach customers:

Your company blog

Video content

Social media marketing

Influencer marketing

Paid search marketing

Organic search marketing / SEO

Email marketing

Newsletters

Plus traditional methods like ads for print, TV, and radio; direct mailing; billboards; and sponsorships.

Initially, newer channels started were cost effective (read: cheap), so even as the number of channels a merchant needed to be involved in was growing, the budget needed to make an impact wasn’t necessarily ballooning up with it. After all, running an email campaign is probably easier and more affordable than designing, printing, and mailing a catalogue, right? But it’s not quite so simple. Now, creating compelling content involves investing in SEO strategists, copywriters, designers, engineers, and others to get messages made and seen.

And merchants have to maintain many of those channels themselves. Instead of just paying for a quarter-page ad in a newspaper, they now have to pay to host a website, to design interactive content, and to make sure it works. In fact, a 2020 survey of over 400 Chief Marketing Officers found that their biggest spend is, in fact, on technology, at 26.2% of their budget, followed by media (24.8%), in-house labor (24.5%), and agencies (23.7%).

More products to compete with on those channels, aka more digital saturation. As customers are inundated with messages across all these new channels, merchants have had to start shelling out the big bucks to stand out. They have to pay more to get the same number of impressions, meaning CAC is rising without necessarily resulting in higher lifetime values or sales.

High rates of customers opting out due to dissatisfaction, aka higher churn rates. Play out what it must feel like to be a consumer. Everything you look at, from your social media feeds to the banner ads on your favorite website to your email, is full of people clamoring for your attention. That’s annoying, but also serves to remind you that there are a ton of people out there offering the same product or service with minute variations. If you have a bad experience—whether that’s one too many emails, a faulty product, or a frustrating experience with customer support—you can leave and go elsewhere. Having lost you, the company you just left needs to...go out and spend even more on acquisition costs to make up for that loss.

Add to that list of CAC-increasing factors a few pandemic-specific disruptions:

Dissolution of previously lucrative channels. In non-pandemic years, trade shows are usually a hugely important marketing avenue, especially for B2B merchants. With those canceled, and other sponsored events off the table, too, companies are spending more trying to rank for keywords relevant to their audience in order to make up for lost leads and sales.

More discerning customers with tighter wallets. Both B2B and B2C companies are finding that their customers might not have quite as much to spend this year compared to years past. With U.S. employment still suffering from the pandemic and 33% of all American adults having to dip into savings to pay their bills, bigger marketing budgets don’t necessarily mean more acquisitions if customers can’t afford to be customers in the first place.

3 ways to offset rising CAC costs

The way we measure CAC is focused around marketing initiatives and how much they cost. But throwing more money at the problem won’t solve it.

The good news: customer acquisition doesn’t have to be shouldered by your marketing team alone. Marketing has other goals too, like generating leads and increasing brand awareness; they shouldn’t be the sole team responsible for driving every customer over the line. What can you be doing with already-existing resources and processes?

Let’s look at three: customer service, sales, and product.

1. Customer service: Acquiring customers is good; retaining them is great. Get more value out of the customers you have and keep them around for longer by providing top-in-class customer service. Solve problems as soon as they happen—or even before they happen.

Extended warranties can help with that. With pre-programmable and fully customizable CTAs that go out on regular cadences post-purchase, you can check in with your customers, gather data about their purchases and what’s working, and immediately solve any problems that come up, capturing a lost sale before it’s lost. Clyde can run all the logistics of your extended warranty program and let you collect on the profit margin. Get a custom quote for your business .

2. Sales: Your sales team knows how to get your product or service into customers’ hands. They’re good at it. The only people who are probably better? The customers themselves. There’s a reason why word-of-mouth advertising works. Per Nielsen , 92% of consumers trust recommendations from friends and family more than any form of advertising. Running a referral program means unlocking that sales potential without having to drop a ton of money on ads or even on salespeople’s salaries; referral incentives don’t have to be extravagant to work.

3. Product: Have you ever seen every engineer’s favorite chart about automation? I’ve sat in at least four cubicle farms that had it posted on the wall:

What are all of the marketing, customer service, or sales processes that you spend money and time (which is money) on now? How much could you save if you automate them? If your customer service reps do a one-month check-in with each new client that takes ten minutes each time, and they do five of those a day, The Chart would say that it’s worth up to six months of time building an automatic tool that can do the same thing. Use your product talent to invest in internal tools like personalized, automated text messaging campaigns or periodic customer check-ins to capture unrealized sales constantly.

Stop CACs’ meteoric rise

While tripling an AdWords budget is one tactic employed by merchants, a holistic approach is far more likely to move the needle in the long run. Building efficient ways to reach new customers, while retaining the ones you already have is a far more effective way to reduce your CAC. Adding an extended warranty program, starting a customer referral program, or automating marketing and customer service tasks are just a few ways to think about these costs in a big picture way.

Questions, comments, or examples of successful tactics that you've employed to combat rising costs? We’re all ears. You can reach out here or via our social channels below.

SIGN UP FOR OUR NEWSLETTER